What impact is the cost of living having on parking?

When discussing the cost of living, essential services like water, electricity, and internet access are often highlighted due to their impact on daily life.

However, the consistent demand for parking, despite economic changes and transportation trends, raises questions about the impact that the cost of living has on the daily commute.

Far from being impacted as other non-essential items may be, research shows that consumers see parking as both a necessary convenience and an indispensable part of daily life.

Despite this, further research reveals a strong demand for affordable and flexible parking options, presenting more opportunities to meet consumers' evolving needs

Financial stress continues to dog consumer confidence

Prior to 2020, Australia's economy was experiencing moderate growth. Key sectors such as mining, agriculture, and services were performing well, contributing to a stable economic environment. Unemployment rates were relatively low and consumer confidence was reasonably strong [1]. However, there were underlying issues, including high levels of household debt and housing affordability concerns, with considerable levels of financial stress despite two decades of a gradual decline [2].

As Australia has emerged from the pandemic, the economy has begun to recover, but the path has been uneven. Supply chain disruptions, labour shortages and inflationary pressures are contributing to ongoing financial stress – exacerbated by the level of debt incurred during the pandemic. All of this has impacted households, which continue to experience financial stress.

The RBA has noted that most mortgage holders ‘have experienced an increase in their minimum scheduled payments of 30–60 per cent since the first increase in the cash rate in May 2022’. The RBA also reports that consumer sentiment across all household types (Outright, Owner-occupiers and Renters) has dramatically dropped since 2021.

Despite these pressures, a strong labour market has continued to offset some of these stressors and the RBA notes that the share of borrowers more at risk of falling behind on their loan represents just less than 2 per cent of variable-rate owner-occupier borrowers.

[1]

The Australian Bureau of Statistics notes that Australia ended 2019 with unemployment at 5.1% after falling from 5.59% in 2017.

[2] Uniting Care Australia noted that: ‘Households with any stress has lowered between 1998-99 and 2019-20 from 36.5 per cent to 32.8 per cent but was as low at 28.5 per cent in 2015-16.’

How is this impacting parking usage and uptake?

Back in March 2023, Wilson Parking was looking ahead at what impact the cost-of-living crisis could have on parking. Looking at NSW as an example, it identified 6 out of 23 key commuter parking postcodes in NSW that were likely to be impacted by mortgage stress. An analysis of commuter behaviour in March 2024 confirmed this, with 3 out of the 6 postcodes identified as being at risk of mortgage stress having reduced their commuter parking - measured by the number of prepay transactions customers made.

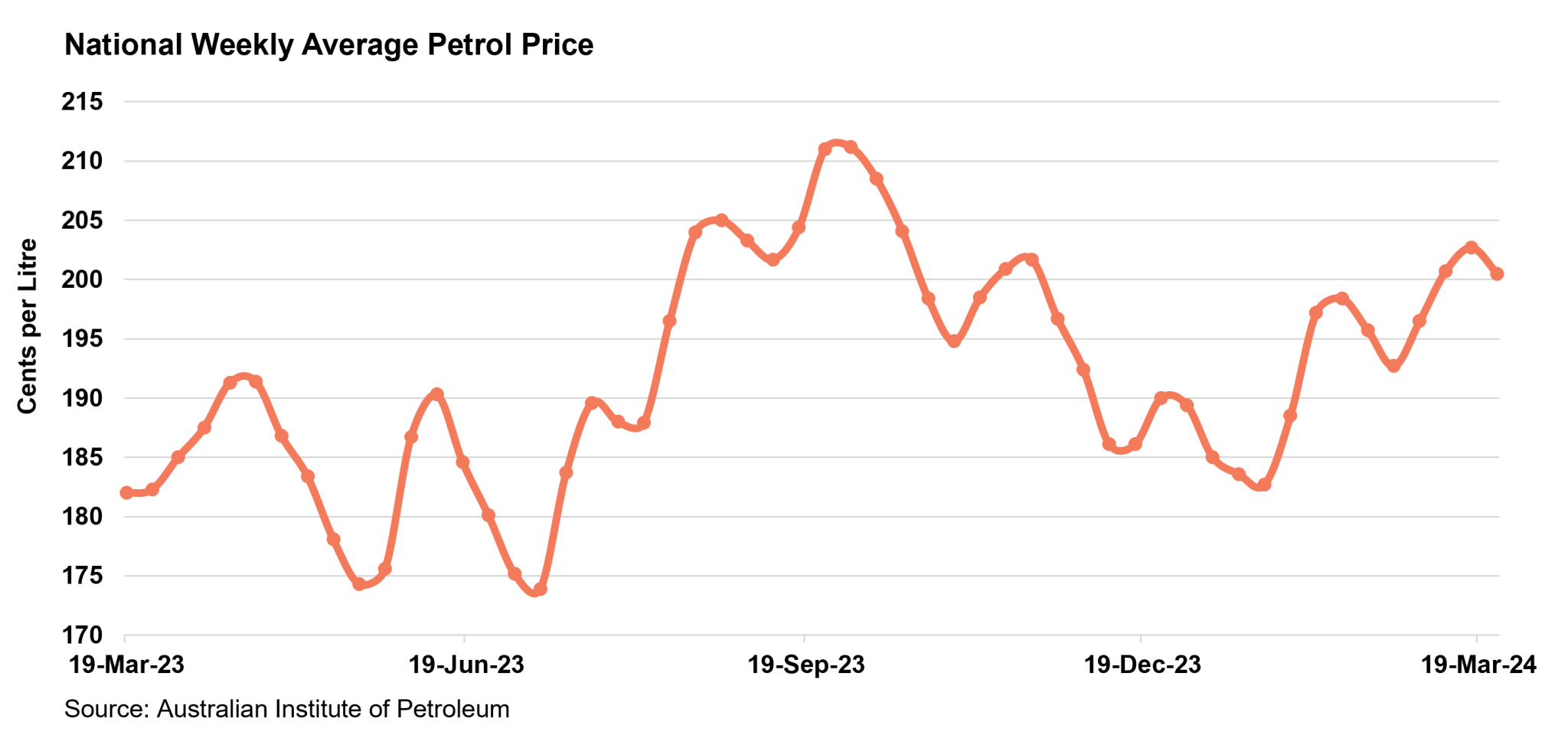

National fuel prices have also increased over the same period, from just above $1.80 per litre in March 2023 to peak above $2.10 in September 2023 before falling and then increasing again to just over $2.00 per litre in March 2024.

Despite significant pressures like these placed on Australian households, research has revealed that overall spending on parking has remained consistent, being more in line with spending patterns of ‘essential’, rather than ‘nice-to-have’ items.

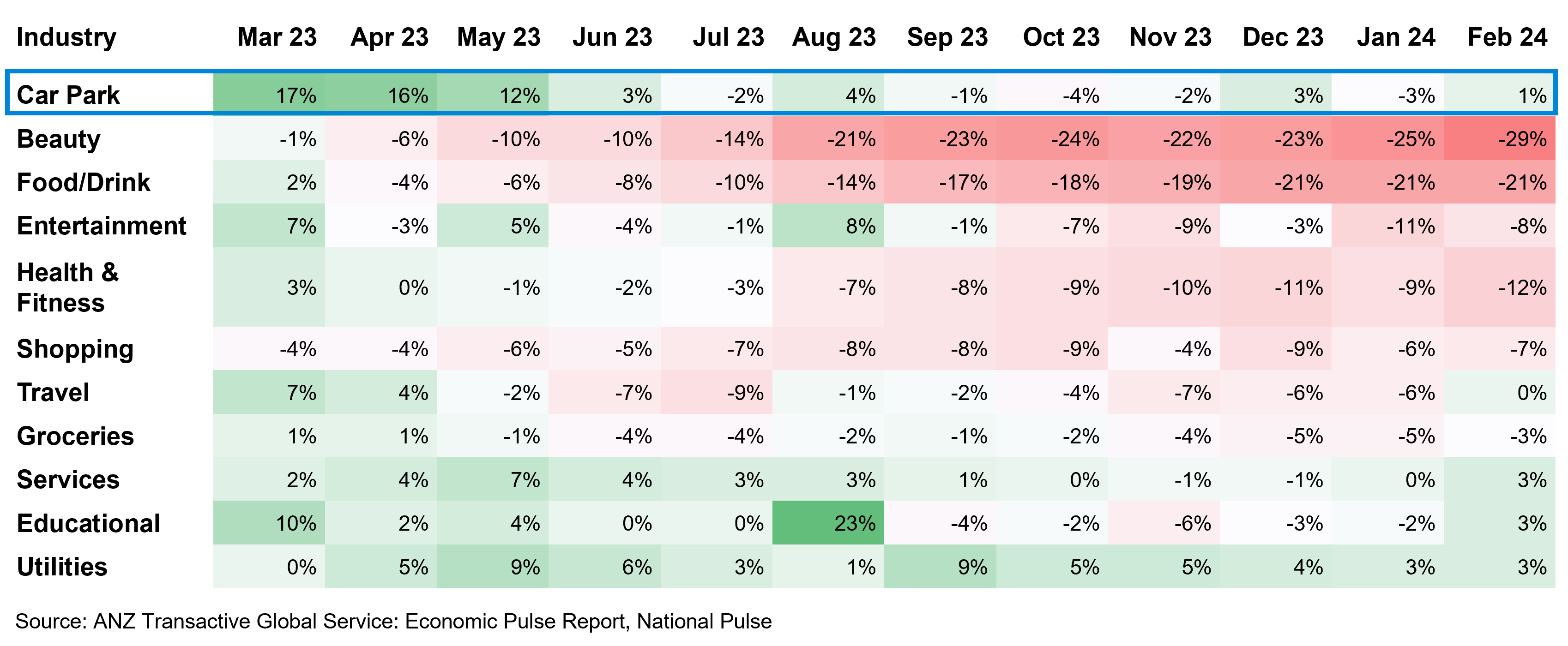

According to ANZ National Pulse data (to February 2024), parking usage remained relatively consistent compared with other products and services. This was despite cost-of-living pressures over this period.

From April 2023 to February 2024, consumer spending on beauty, food/drink and health/fitness saw relatively consistent and increasing falls. There were somewhat smaller falls in consumer spending on shopping and entertainment. In other words, discretionary spending decreased during this period, but consumers remained consistent on essential products and services, with parking coming under this umbrella.

Why do consumers prioritise parking?

In recent years a new commuter class has dramatically shifted parking’s service offering and continues to shape both the scale and nature of demand and how its responded to by the industry.

Juggler commuters are a deviation from the traditional commuter working 9-5. Thanks to the rise of hybrid working schedules, jugglers demand adaptability from not just their employers but their services, making it essential to design parking solutions that cater to their diverse needs.

Research reveals that CBD employees are choosing Tuesday, Wednesday and Thursday to come into the office, with Monday and Friday seeing drops of approximately 20% since pre-2020 levels. Peak times have also blurred as 46% of drivers enjoying flexibility with when they leave and arrive at a car park. This means businesses are seeking new ways to maximise staff parking allocation while individual commuters are seeking flexible parking options.

Only a fraction of commuters maintain consistent schedules, with a quarter of drivers typically leaving or arriving at the same time each day [1].

A 2024 Adaptive Spaces report from CBRE also points to a gradual return to working practices seen prior to 2020. In Melbourne, a city where hybrid working has dominated the CBD more than many other Australian centres, office occupancy rates have risen to 62% in March 2024. But again, the report shows that the peak occupancy occurs from Tuesday to Thursday.

It’s clear from these figures that commuters prioritise parking spend, regardless of economic conditions, as it facilitates access to work while providing the convenience to juggle their commute with their other needs, such as school pickups, grocery shopping and other amenities.

Looking ahead, the rise of hybrid schedules is set to continue to reshape parking demand and usage. The increasing prevalence of 'juggler commuters' requires innovative parking solutions that offer flexibility and ease. By staying attuned to these emerging trends, parking providers can better cater to this demand, ensuring that parking remains not just a seamless and essential part of commuters’ daily lives as well as an increasingly attractive offering for other consumer segments.

[1]

2023 Household Commuter Behaviour Preferences Survey, Wilson Parking